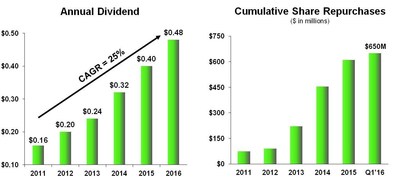

PolyOne Board of Directors Declares Quarterly Dividend, Expands Share Repurchase Authorization

2016年5月12日

In addition, the Board increased the company's share repurchase authorization amount by 7.3 million shares to 10 million shares in total.

"We remain committed to enhancing our return to shareholders with a combination of cash dividends and share repurchases," said

It is anticipated that the company will buy back shares through open market purchases or privately negotiated transactions from time to time. The number of shares to be purchased and the timing of the purchases will depend upon the prevailing market prices and other considerations. The authorization has no time limit and may be suspended or discontinued at any time.

About

To access

Forward-looking Statements

In this press release, statements that are not reported financial results or other historical information are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give current expectations or forecasts of future events and are not guarantees of future performance. They are based on management's expectations that involve a number of business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. They use words such as "will," "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," and other words and terms of similar meaning in connection with any discussion of future operating or financial condition, performance and/or sales. Factors that could cause actual results to differ materially from those implied by these forward-looking statements include, but are not limited to: our ability to realize anticipated savings and operational benefits from the realignment of assets, including the closure of manufacturing facilities; the timing of closings and shifts of production to new facilities related to asset realignments and any unforeseen loss of customers and/or disruptions of service or quality caused by such closings and/or production shifts; separation and severance amounts that differ from original estimates; amounts for non-cash charges related to asset write-offs and accelerated depreciation realignments of property, plant and equipment, that differ from original estimates; our ability to identify and evaluate acquisition targets and consummate acquisitions; the ability to successfully integrate acquired businesses into our operations, including whether such businesses will be accretive to our earnings, retain the management teams of acquired businesses, and retain relationships with customers of acquired businesses; disruptions, uncertainty or volatility in the credit markets that could adversely impact the availability of credit already arranged and the availability and cost of credit in the future; the financial condition of our customers, including the ability of customers (especially those that may be highly leveraged and those with inadequate liquidity) to maintain their credit availability; the speed and extent of an economic recovery, including the recovery of the housing market; our ability to achieve new business gains; the effect on foreign operations of currency fluctuations, tariffs and other political, economic and regulatory risks; changes in polymer consumption growth rates and laws and regulations regarding the disposal of plastic in jurisdictions where we conduct business; changes in global industry capacity or in the rate at which anticipated changes in industry capacity come online; fluctuations in raw material prices, quality and supply and in energy prices and supply; production outages or material costs associated with scheduled or unscheduled maintenance programs; unanticipated developments that could occur with respect to contingencies such as litigation and environmental matters; an inability to achieve or delays in achieving or achievement of less than the anticipated financial benefit from initiatives related to working capital reductions, cost reductions and employee productivity goals; an inability to raise or sustain prices for products or services; an inability to maintain appropriate relations with unions and employees; our ability to continue to pay cash dividends; the amount and timing of repurchases of our common shares, if any; and other factors affecting our business beyond our control, including, without limitation, changes in the general economy, changes in interest rates and changes in the rate of inflation. The above list of factors is not exhaustive.

We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any further disclosures we make on related subjects in our reports on Form 10-Q, 8-K and 10-K that we provide to the

Photo - http://photos.prnewswire.com/prnh/20160512/366926

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/polyone-board-of-directors-declares-quarterly-dividend-expands-share-repurchase-authorization-300267935.html

SOURCE

Investor Relations Contact - Eric R. Swanson, Director, Investor Relations, PolyOne Corporation, +1 440-930-1018, eric.swanson@avient.com; Media Contact - Kyle G. Rose, Vice President, Corporate Communications, PolyOne Corporation, +1 440-930-3162, kyle.rose@avient.com